Despite the doom and gloom of rising interest rates, elevated inflation, the fear of a wide recession and the continued war in Ukraine, global equity markets have actually risen in 2023.

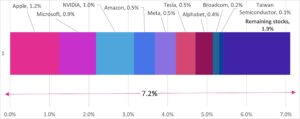

For UK based investors, they have delivered 7.2%[1] to the end of June, recovering most of 2022’s fall.

Markets are forward looking and pretty good at reflecting all information publicly available to investors in current stock prices.

In 2023 so far, the forward looking market view for a very small number of stocks has been extremely positive and this has been reflected in a rapid upsurge in their prices.

In fact, just nine companies accounted for three-quarters of the 7.2% rise in global markets this year, as illustrated in the chart below.

The remaining stocks in the global markets delivered just one quarter of the total 7.2% rise.

Individual company contributions to the global equity market return of 7.2%

Source: Albion Strategic Consulting (see footnote 1)

Some speculate that the increase in value for these stocks may be due to the market pricing in its view on the benefits of the AI revolution for these stocks.

The important thing to note is that no-one knew that the rapid rises in these companies’ stock prices were going to happen in advance. Similarly, no-one knows where they go from here. Prices move on the release of new information which is, by definition, random.

It may be good news for these companies, or it may not be.

Such concentrated price moves may make some investors wish that they had held more in these stocks, but that is to succumb to the power of perfect hindsight.

Others will feel a fear of missing out (FOMO) and dive in hoping that recent past gains continue, succumbing to recency bias.

Sensible, evidence-based investors will simply feel glad that they have captured the market returns using the wide net of a well-diversified index fund portfolio.

[1] Including developed & emerging markets. After fund costs return for Vanguard FTSE Global All Cap Index (£ Acc) for 1 January to 30 June 2023. Not a recommendation – illustrative purposes only.

This communication is for general information only and is not intended to be individual advice. You are recommended to seek competent professional advice before taking any action. Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.