‘Sitting on the fence’ syndrome is a new phrase the financial press is using to describe current investor sentiment.

The last few years have been a tough time for investors. Inflation and rising interest rates have played havoc with markets, and this has caused a great deal of emotional stress for some investors. Naturally, short termism is at the front of mind, and this can prevent investors acting rationally when approaching their decision making.

Cash rates are very topical currently. This isn’t a surprise as interest rates are the highest they’ve been for over 15 years. And given investment market volatility, this makes a 5% cash interest rate even more attractive to some. So, should you still bother with investing? Is it worth the trouble given the up and down journey of markets compared to cash that now seems a lot safer, and more attractive?

The answer is, of course, yes! Whilst choosing cash over investments may seem like the right decision in the short term, the long-term track record of that decision could have a major negative impact.

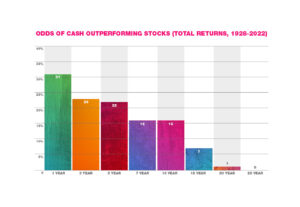

Since 1928, cash has beaten the stock market 31% of the time over a one-year period. But as time goes on, the chance of cash beating the stock market reduces significantly. In fact, there has never been a 25-year period where cash has outperformed the stock market.

Source: Cash Is No Longer Trash, but the Opportunity Cost Might Be Greater Than You Think | Morningstar

This data shouldn’t be a surprise. The stock market goes up more often than it goes down. So, more often than not, the stock market will outperform cash. However, we know that investors make decisions emotionally and typically place an unfair weighting on short term factors; defeating this mindset is a challenge.

WHAT COULD IT COST INVESTORS BY SITTING ON CASH?

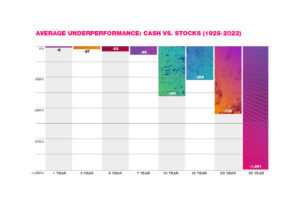

On average, history tells us that cash underperforms the stock market by 8% over one-year periods. But the differential increases hugely over time.

Over a five-year period, the average difference between the stock market and cash is more than 50%. Over 20 years, it’s more than 700%!

Source: Cash Is No Longer Trash, but the Opportunity Cost Might Be Greater Than You Think | Morningstar

The message is clear from the long-term data: The opportunity cost of sitting in cash is huge and grows over time. We also know that the biggest returns can come in small periods of time. Trying to time when to be in cash and when to be invested is proven to be a bad investment strategy. Professional fund managers do a poor job of market timing and so do the majority of DIY investors.

This is where having a financial plan becomes so vital. Cash is important for an investor’s short term needs; an emergency fund, a capital spending pot and an income reserve.

Outside of this, funds should be invested for the long term, in a sensibly diversified portfolio to aim to achieve the higher returns of investment markets. Yes, cash rates look good at the moment, but don’t let it stop you making a sensible long-term decision with your money as part of your financial plan.

This communication is for general information only and is not intended to be individual advice. You are recommended to seek competent professional advice before taking any action. Past performance can’t guarantee what investments will do in the future. The value of a portfolio can go down as well as up, so there’s a chance you’d get back less than you put in.