SECOND OPINION

PUTS YOU & YOUR FINANCES FIRST

Current market uncertainties can mean a worrying time for your finances.

Perhaps you’ve got a niggling doubt that you’re not getting the best out of your current set up.

Or maybe one of your nearest and dearest doesn’t have the same relationship with their advisor as you have.

Interestingly, 81% of people are thinking about moving money away from their current advisor. (Source: CEG Worldwide).

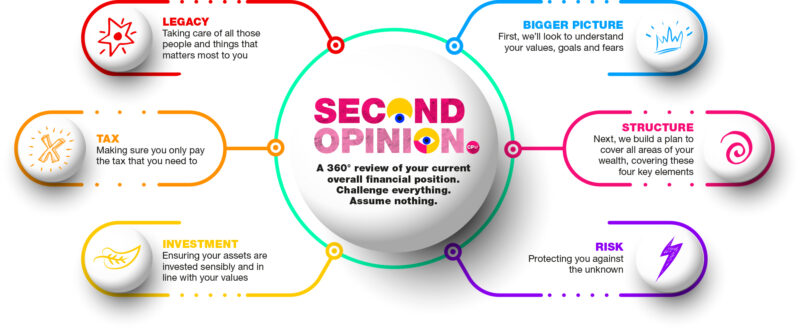

Introducing Second Opinion. Our reassuring sense check to confirm everything’s just as it should be.

HOW DOES IT WORK?

It’s a second opinion from first-class, award-winning, experts. It won’t cost you a bean. And there’s no obligation.

This diagram shows what we look at. In a 360° kind of way.

Look at it this way. We just want everyone to realise their dreams.

So, if we run our Second Opinion review and everything looks tickety-boo – then great, you’re being well served by your wealth adviser. You can relax.

But if we think there are areas for improvement, we’ll also suggest the best way to move forward.

WHY US?

With CPW, you’ll be in safe hands.

95% of our clients said they’d be happy to recommend us in our recent feedback survey.

Let’s talk today

Want us to call you? Let’s start a conversation!