Most investors are aware that in the past few years, the US equity market has delivered above-average returns, compared to many other markets. There has also been quite a lot written in the media lately pointing out that just a handful of stocks have driven most of the US returns.

Some return-focused investors might look at this and wonder whether they should own more in the US. Fear of missing out (FOMO) might tempt you into increasing your exposure to the US or even these few specific stocks.

That, however, would be succumbing to recency bias, where you’re influenced largely by what has just happened and are extrapolating this into the future. Someone who is so return-focused should, to be consistent in their logic, be eyeing the Danish stock market which has outperformed the US over the past 20 years, by around 5% per annum on average, driven largely by one stock – Novo Nordisk, which is 60% of the market!

On the other hand, more risk-focused investors may be becoming increasingly concerned by the continued rise in those mega US companies and the increasing concentrations of their portfolios. The risk of either absolute failure or simply future underperformance, which can follow a period of extreme outperformance, is not appealing. Not doing something about this might become a source of concern, and ultimately, regret.

There is a simple, systematic solution to this conundrum: owning a portfolio that is exceptionally well diversified across markets, sectors, capitalisations (mega to small companies) and tilted towards value-oriented stocks.

Looking under the bonnet at the holdings within different portfolios provides useful insights into the choices on offer to investors.

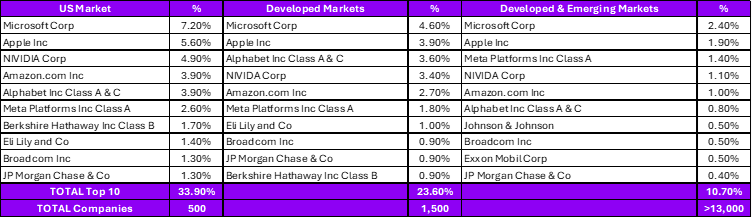

The table below looks at the stock concentration of three different portfolios, which track:

- the US Equity Market using the S&P 500 index [1]

- Developed Markets using the MSCI World Index [2]

- Developed & Emerging Markets with tilts towards mid-cap and smaller companies, and value stocks [3]

Top 10 companies as a percentage of portfolios

Source: Morningstar Direct ©. All rights reserved (see Endnote for full details)

The first point of note is the difference in the total number of stocks in each portfolio – ranging from only 500 to over 13,000.

It is notable how concentrated a US market portfolio can be, with over a third of this portfolio made up of just ten companies (left column).

Diversifying into other developed markets improves diversification with around one-quarter of the portfolio made up of the ten largest companies (middle column).

Extending your portfolio further, into emerging markets and spreading out some of the allocation across smaller companies and value stocks (which have higher expected returns), provides a material improvement in the portfolio’s diversification (right column).

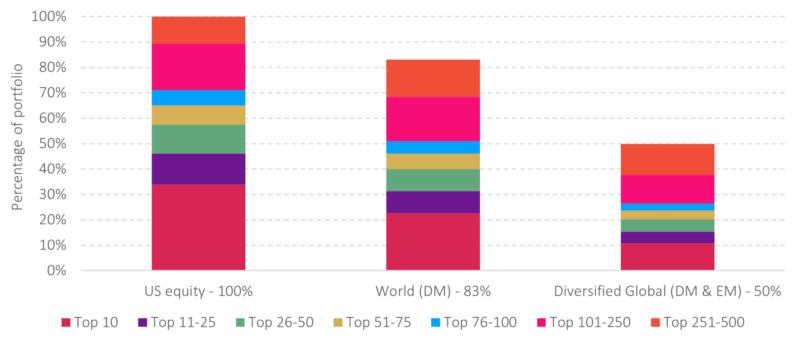

Looking at this in a different way, in the chart below, you can see that the top 500 holdings in each of the three portfolio options represent from 100% of the portfolio, in the case of US equities to only 50% of the highly diversified Developed & Emerging Markets option.

How much of the portfolio the Top 500 companies represent

Source: Morningstar Direct ©. All rights reserved (see Endnote for full details)

Diversification matters because most clients will own their portfolios for many years, if not decades and are therefore focused on investment returns over the long term. We know that the markets do a pretty good job of incorporating information into prices. We have no forward-looking insight into which company’s shares are going to outperform. But we can avoid both FOMO and regret by walking a sensible path and owning a well-diversified portfolio.

If you are interested in learning more about Cooper Parry Wealth’s approach to investment, it’s HERE.

Suffering from FOMO? Get in touch with your usual Cooper Parry Wealth contact or give us a shout at theteam@cooperparry.com.

This communication is for general information only and is not intended to be individual advice. You are recommended to seek competent professional advice before taking any action.

Past performance can’t guarantee what investments will do in the future. The value of an investment can go down as well as up, so there’s a chance you’d get back less than you put in.

[1] iShares Core S&P 500 ETF USD Acc

[2] iShares MSCI World ETF USD Dist.

[3] Dimensional World Equity GBP Dist.